U.S. equities attempted to rally at the end of last week as Russian President Putin claimed some progress in talks with Ukraine. Indexes finished near the lows, extending the 2022 losing streak. Months of anticipation will reveal in the Fed’s interest rate decision this week, the beginning of rate hikes. Surging energy prices and inflation is largely attributable to supply-side challenges, yet the Fed believes the current policy is too loose. The S&P 500 and Nasdaq Composite indexes fell more than 3% last week.

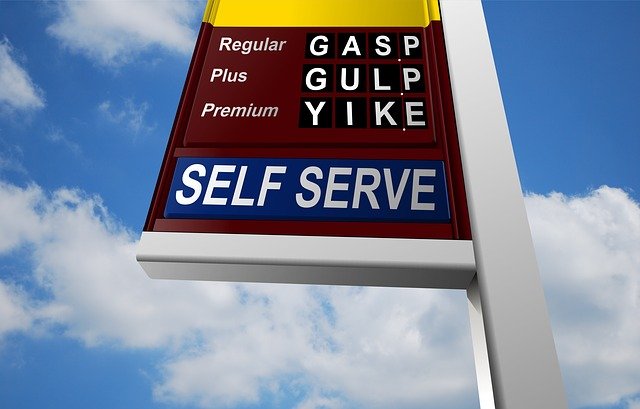

Last Week – Energy Prices

The stock market losing streak continued. The DJIA was down 1.99%, while the S&P 500 was off 2.88%, and the Nasdaq Composite declined 3.53% for the week. On Tuesday, the NFIB small business optimism index for February slipped to 95.7. Lower than January’s reading of 97.1. Small business owners are feeling the impacts of wage inflation and rising fuel costs. On Wednesday, weekly mortgage applications rose 8.5% overall. Both originations and refinancing’s were up in high single digits among rising rates.

Weekly initial unemployment claims moved higher on Thursday, to 227,000 from the pandemic low of 216,000 the prior week. The big inflation data last week was the February consumer price index (CPI) report. The all-items CPI rose 7.9% annually, the highest in 40 years. Energy prices soared as the war in Europe continues. The core index, which excludes food and fuel, rose 0.5% monthly and 6.4% annually. The Russian invasion dismissed belief of cooling inflation. The War in Europe has spiked petroleum prices around the world. Wrapping the data week on Friday, University of Michigan consumer sentiment for March slipped below 60 to 59.7. Consumer sentiment reached 10-year lows. On top of inflation concerns, the war in Europe is adding to general geopolitical anxiety.

Week Ahead

The markets may need the Luck of the Irish on Thursday to snap the losing streak. The February Producer Price Index estimates to rise 1.0% month-over-month and 10% annually. The core PPI estimate to rise 0.6% monthly and 8.3% annually. Wednesday retail sales report, expected to rise 0.5% for February after the surprising 3.8% gain for January. Inflation is causing consumers to spend more for less and potentially cutting into savings. Most experts agree the Fed’s hiking path is likely to be slower than previously expected considering the war in Europe. The current reports believe a 0.25% rise in interest rates on Wednesday.

The NAHB housing market index estimate for March is the low 80s, in line with February’s 82. On Thursday, February housing starts are forecast at a 1.700 million SAAR (seasonally adjusted). This would be an improvement from the 1.638 million SAAR for January. Capacity utilization is forecast to edge higher to 77.8% from 77.6% for January. Factories continue to run all-out to address the supply-chain crisis. On Friday, existing home sales report estimated to come in at a 6.17 million SAAR for February. This would be a decline from a 6.50 million SAAR for January.

Year-to-date index performance; Dow down 9.3%, S&P down 11.8%, and Nasdaq down 17.9% through the close on Friday.

Financial Advisor Erie CO focus on investment and wealth management, retirement planning; Boulder, Louisville, Niwot, Lafayette, Windsor, Berthoud, CO

This website is for informational purposes only and is not intended to be specific advice or recommendations. For specific advice or recommendations you would need to meet directly with one of our advisers.