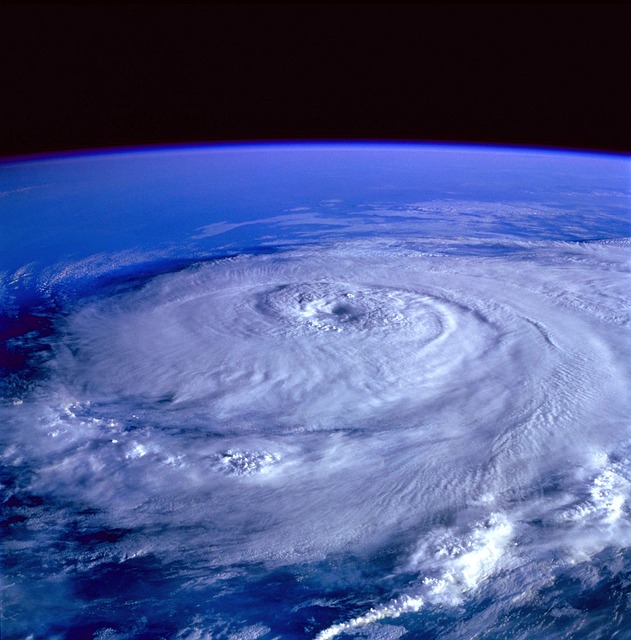

Hurricane Helene has left a mark not just on the landscape, but also on the lives of countless people across the southeastern U.S. And Hurricane Milton is about to reach land today, wreaking havoc again on an already damaged area. If you’ve watched the news coverage, or know people it’s affected personally, it’s easy to see the massive impact this storm has had. It’s during times like these that our priorities will suddenly shift in unexpected ways.

As we journey through the ever-changing financial landscape, it’s easy to become distracted by the dazzling allure of foreign opportunities and the seemingly effortless successes of others. The age-old adage “the grass is always greener on the other side” can often tempt us to cast our gaze outward, pondering possibilities that seem perpetually just beyond our grasp. But in doing so, you risk overlooking the fertile ground upon which you currently stand.

Amidst the daily din and ceaseless wave of headlines, it’s crucial to resist the fallacy that fulfillment lies somewhere other than in the present. True prosperity stems not from flitting from one external opportunity to another but from deeply understanding and nurturing your own immediate situation.

Your financial journey is unique and deeply personal, based on an array of circumstances, opportunities, and challenges. Never forget the powerful potential that resides in careful planning, thoughtful action, and a dedicated commitment to improvement. Contentment and prosperity are born from making informed, deliberate choices within the framework of the present. All in order to benefit the future for you and your loved ones. Having a plan in place before disaster strikes can make all the difference in your day-to-day and overall sense of security and well-being. Preparation can be a powerful tool in managing stress and uncertainty effectively.

What’s the first thing you think of when a storm threatens your household? Reconnect with the potential that lies right where you are. Together turning the dream of what seems greener elsewhere into your own thriving present and future reality.

Last Week – Hurricane

U.S. equity indices clawed back earlier losses, and interest rates jumped after Friday’s much stronger-than-expected jobs report calmed recession fears. The S&P 500 and Nasdaq indices ended slightly positive for the week ending October 4. September’s non-farm payrolls came in well above expectations. The unemployment rate dropped down to 4.1%, and wage growth topped estimates. A slower pace of interest rate cuts may be a likely result of the stable jobs report. Investors were reassured that the U.S. economy remains on solid footing. On Monday, Fed Chair Powell said the committee is not in a hurry to cut rates quickly. He continued adding that the FOMC will let the data guide its decisions. Weekly jobless claims remain low. However, the data may be distorted in coming weeks due to Hurricane Helene, Hurricane Milton, and the strike at Boeing.

This Week

Thus far, the Middle East conflict has only materially impacted energy markets. But investors are seemingly wary of any further escalation in tensions negatively affecting other global risk assets. There is some risk of an upside surprise in tomorrows U.S. CPI report. The ISM PMI services data showed prices charged by businesses rising at the fastest rate in six months. Such an outcome would reinforce the likelihood of quarter-point interest rate reductions going forward.

A slower rate cut pace has been the sentiment from Chair Powell and committee members who have spoken publicly recently. So today’s release of the minutes from that meeting may have little to reveal. Third-quarter EPS season is now underway and the next three weeks will be very heavy with earnings reports. Just prior to and just after earnings reports, companies are in a blackout period. During that time, a company cannot repurchase its stock. Large U.S. banks JP Morgan Chase, Wells Fargo, and Bank of New York Mellon kick off earnings season on Friday.

Have a great week!

Erie CO Financial Advisor; investments, wealth management, retirement income planning; Boulder, Broomfield, Louisville, Niwot, Windsor, Berthoud CO

This website is for informational purposes only and is not intended to be specific advice or recommendations. For specific advice or recommendations you would need to meet directly with one of our advisers. This is not a solicitation or offer of service in states we are not licensed in.