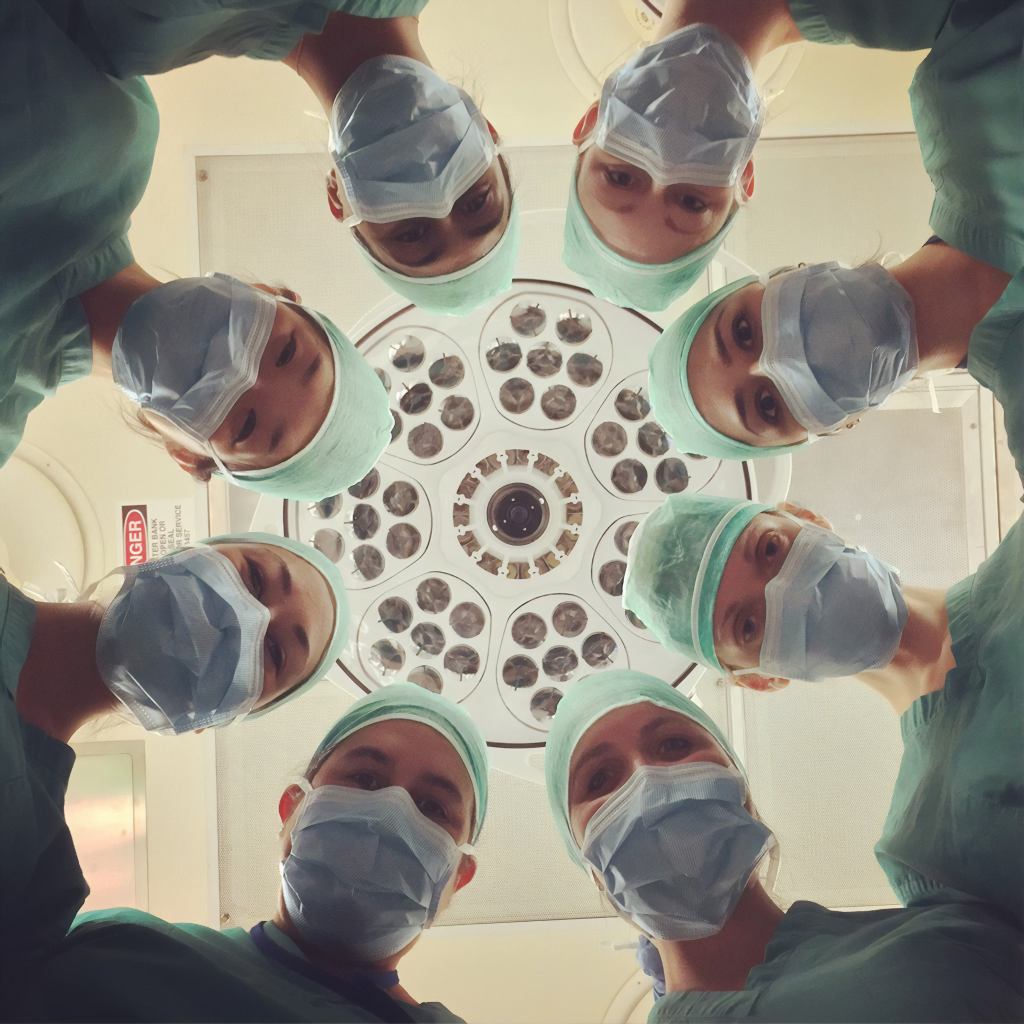

Experienced Doctors (residents scroll down)

Is it time for a second opinion? Are you on track to reach your retirement goal? Is your portfolio positioned correctly to support the lifestyle and expenses of what could be a 30+ year retirement?

When loved ones are sick or need surgery, families are looking for the best and proper care. When wealth is improperly cared for, the legacy evaporates – wealth erosion. Proper care of your wealth enhances your retirement lifestyle and allows for the legacy you dreamed of.

Second opinions, just like in the medical world, are free with no obligation. You may already work with a financial professional today or you may by seeking a new relationship after being turned off by the sales pitch over the free dinner. Whatever the reason, get started today. Much like your health, when you are told you need surgery or treatment needs to start, it’s worth seeking a second opinion for confirmation.

Jump to: Financial Goals – Retirement – Wealth Management – Home

Resident or Doctors who recently completed residency

Where do I start with planning for retirement, investing my earnings, understanding benefits, and setting financial goals? Help me understand the process.

- Casual Consultation – similar to an initial exam. Who are you, what are you doing, and where do you want to go.

- Assessment – after understanding your history and goals, we perform an overall financial health risk assessment.

- Vitals – how is everything working. What needs to be improved?

- Exam Results – compare the current results with your financial goals. What changes need to be made?

- Ongoing Discussions – Similar to health, one financial meeting does not solve all your problems. Creating wealth takes deliberate, intentional, and ongoing execution. Your health can change, so can your financial goals/personal situation. It is best to have a proactive approach to building wealth and reaching your retirement goals.

Whether you need help paying down debt, setting a goal for retirement, or understanding all the benefits offered through your employer, this is the place to start.

Jump to: Financial Goals – Retirement – Wealth Management – Home

Doctor FAQs

Yes. Our clients live all over the United States. Everything we do can be accomplished with a phone and a computer.

Fee-only means no commissions from investment products. Management fees depend on your needs and complexity, and are a transparent line item on every statement.

Some advisors are commission based, which may cause fees to be hidden or create conflicts of interest. One transparent fee includes the management of all your investment accounts and ongoing retirement planning.

Besides being fee-only, independent, and operating under the fiduciary standard, there are three really important things about our firm that separate us from others:

1) Retirement planning and investment management focus with a simple goal of making sure you reach your financial goals.

2) Limit the number of new clients to deliver max value and personalized service.

3) Investment in leading technology to simplify our clients' lives and make the retirement planning process easy.

A second opinion is a complimentary review of your investments and retirement plan as it stands today. We can determine if you are heading in the right direction, or need to change course. Does it make sense for someone to speak to a doctor to check their health if there is no cost? A second opinion is just that. If you are good, we will confirm and send you on your way. If you need to see a specialist to improve your financial health, we will let you know. And there is no obligation to work with us.

Fee-only, aka no commissions from "hard-sell products." Fiduciary standard of care, meaning your interest come first throughout the entire length of our relationship. Independent - the shingle we hang is our own, not a national brand where we report to a manager telling us to push a product at all of our clients to make the "company trip." If you’re looking for an advisor who will trade stocks to “beat the market,” you’re in the wrong place.

We only focus on what you can control. Predicting if the stock market will go up or down, or guessing what interest rates will do next, are not things you can control. But if you’re interested in things like lowering tax consequences, investing smarter, and creating a reliable income stream in retirement, you’re in the right place.

Yes, if paying off debt is part of your financial goals we will build a plan that includes eliminating or paying down your outstanding debts.

Understood. You need to start somewhere. The important part is getting a plan in place. The sooner you define why you are busting your ass in scrubs, the sooner your goals can be reached.

To be expected. The majority of our clients come from an existing advisor relationship that for whatever reason is no longer working for the clients. This includes lack of communication, not meeting with or hearing from in years, the previous advisor was retiring (or changing careers), the clients were passed on to a new/younger advisor at the firm whom they did not have a connection, the clients are unsure of the advice they are receiving, the clients did not feel as though their interests were front of mind with the previous firm, to name a few.

Majority of the initial design and implementation is upfront. This can take up to a few meetings depending upon the complexity of your situation. Going forward, we meet formally at least annually, sometimes more, with check-ins periodically throughout the year as needed.

Great! We will still start with a brief call to ensure RMFS is the right fit for you.

Submit the "Schedule a Call" or "Retirement Review & Portfolio Audit" form. Alternatively, you can call or text the office at 720-600-7599, or email jim@rmfinancialsolutions.com to setup a time to connect. We will return to you within 24-48 hours.

Submitting the "Schedule a Call" or "Retirement Review & Portfolio Audit" forms are best. Alternatively, you can call or text the office at 720-600-7599, or email jim@rmfinancialsolutions.com. We will return to you within 24-48 hours.

I will most certainly be interested! Depending on workload and client meetings will dictate availability 😉

Financial advisor for doctors. Servicing clients across the country to assist them in reaching their financial goals. How can I help?

Click here if you would like to learn more about your options and if we can assist you with your wealth management, investment, and retirement planning.

This website is for informational purposes only and is not intended to be specific advice or recommendations. For specific advice or recommendations you would need to meet directly with one of our advisers. This is not a solicitation or offer of service in states we are not licensed in.